Case Study

nClouds AWS Case Study | UpEquity

UpEquity’s mission is to transform the home-buying experience by giving every person the opportunity to make a competitive, winning offer on their dream home. Its Buy with Cash program helps homebuyers make an all-cash offer that’s 4X more likely to be accepted than traditional mortgages. UpEquity’s differentiated mortgage technology works at superhuman speed to provide a painless, fast mortgage experience for its customers. The Austin-based firm has experienced 9X growth in the last year and carries a Net Promoter Score 3X the industry average, further highlighting the company’s truly unique approach in an otherwise saturated market. For more information about UpEquity, go to: upequity.com

Industry

Location

The Challenge

Featured Services

Automation for accelerated innovation

Cost optimization

Enhanced compliance, security, and governance

CHALLENGE

UpEquity needed an uncomplicated way to govern multiple AWS accounts, easily provision/decommission AWS accounts, and maintain Payment Card Industry (PCI) compliance.

“nClouds built a solid architectural foundation for the launch of UpEquity. They applied their deep AWS experience and DevOps skills to support our rapid growth and innovation.”

THE SOLUTION

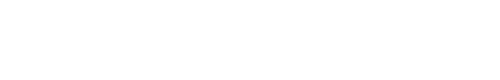

UpEquity’s mortgage application was in a proof-of-concept stage when they approached nClouds to build the foundation of their AWS infrastructure to support that application. nClouds recommended a multi-account strategy to enable UpEquity to support innovation and agility, group workloads based on business purpose and ownership, apply distinct security controls by environment, constrain access to sensitive data, and limit the scope of impact from adverse events. nClouds applied best practices of a well-architected multi-account AWS environment by implementing AWS Organizations.

Ready to Accelerate?

No matter where you are in your cloud journey, we can help you migrate, modernize, and manage your AWS environment. Let’s accelerate your growth and fast-track your business outcomes.